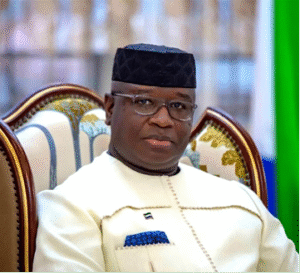

In a major shift from the normal government operations, His Excellency President Julius Maada Bio has directed Cabinet and in particular the Minister of Finance Honourable Sheku Fantamadi Bangura to design the 2026 budget in a way that it will reduce economic burden on families and households. Specifically, impeccable sources say, he has asked for a fiscal plan to focus on household relief and align with regional standards

In a decisive move to shape the nation’s economic direction, His Excellency President Julius Maada Bio has directed the Cabinet and Ministry of Finance to anchor the 2026 Budget firmly in principles of fairness, inclusivity, and people-centered development.

The directive signals the government’s intent to advance its agenda for basic service delivery and state strengthening, even in the face of persistent global economic headwinds.

Central to the budget’s “pro-people” focus are concrete measures designed to lower the cost of living for ordinary Sierra Leoneans. Key among these is the proposed removal of duties on LPG gas and solar technologies, a move intended to make clean cooking and energy more affordable and directly cushion families against inflation.

“We cannot control global fuel prices or external shocks,” a senior presidential aide stated, “but we can and will cushion our households and protect the most vulnerable. This budget is the instrument for that.”

Closing the Gap: Tax Reforms for National Stability

The 2026 Finance Bill will also address a critical fiscal challenge: Sierra Leone’s tax-to-GDP ratio, which at 9.8% ranks among the lowest in West Africa and is far below the ECOWAS benchmark of 20%. Officials frame the upcoming reforms not as a punitive measure, but as a necessary step toward regional parity and long-term national stability. The bill will prioritize closing tax loopholes, curbing revenue manipulation, and broadening compliance to strengthen the state’s capacity to fund essential services.

This budget, expected to be tabled in Parliament on Friday November 28, will be a critical test of the government’s ability to balance immediate public relief with the structural reforms needed for sustainable growth.